Magstipe card technology is now over 40 years old and has resulted in untold millions of dollars worth of losses through fraud. These easily-hacked cards contain extremely sensitive static information and data that can be cloned. In 2016 alone, credit card fraud is set to hit $4 billion, as hackers make their last attempts to cash in before magnetic strips are completely replaced with chip technology in the banking sector.

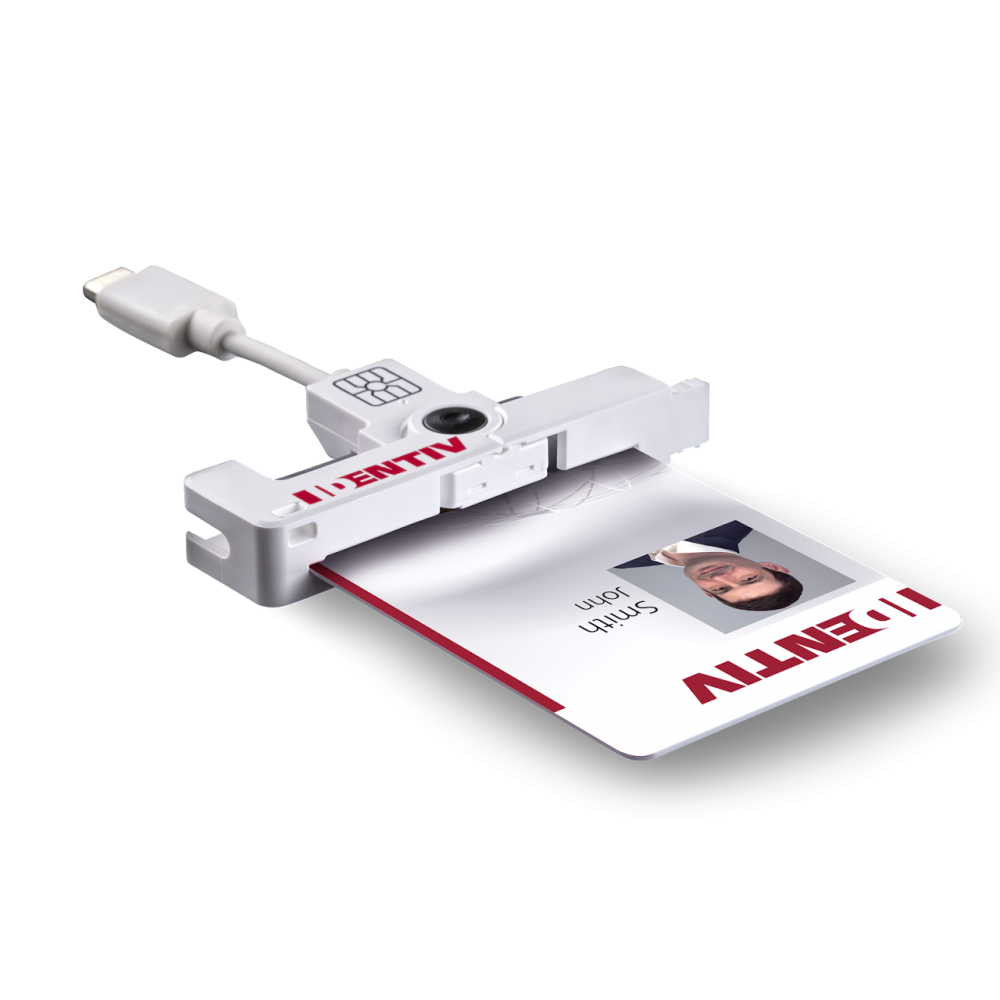

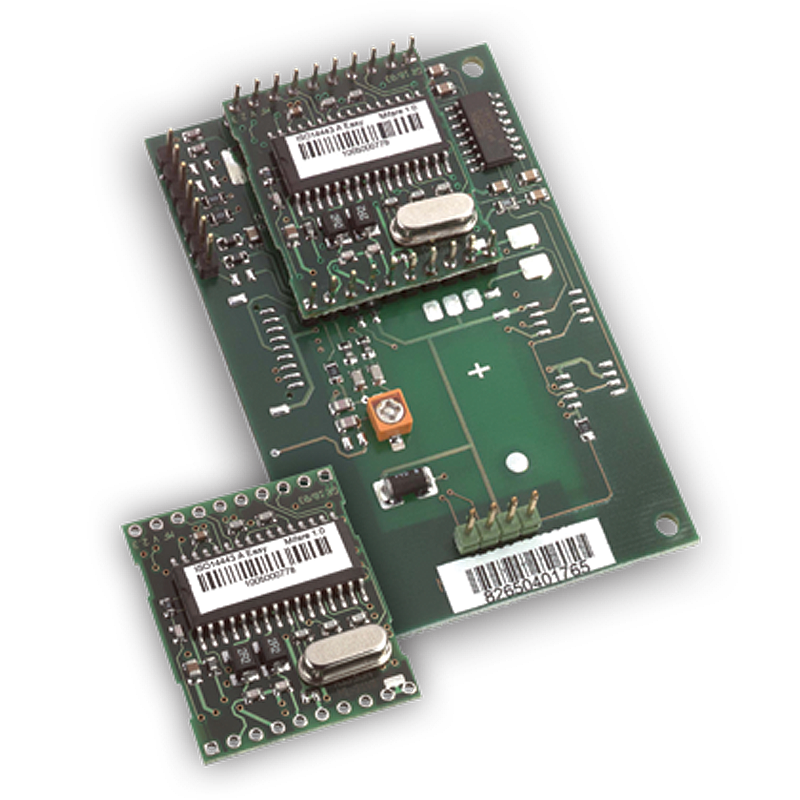

The solution to magstripe fraud: RFID and chip-based cards, such as EMV cards (which stands for Europay, MasterCard, and Visa-the companies responsible for the new technology). This advanced technology has long been integrated throughout UK, Europe, Asia, and Canada over the past decade, ensuring higher security. The U.S. is now actively enforcing the transition to the chip-based card systems. Nevertheless, a concerning amount of universities in the U.S. are still on the magstripe system. Smart Cards offer a much more secure option for keeping information and credentials safe and secure. The embedded microchip technology make these smart cards much more difficult and expensive for criminals to fabricate, clone, and steal information from.

Unfortunately, EMV technology has yet to completely eliminate fraud in places like the UK, Europe, and Canada, who have already made the switch to EMV systems. Since the integration has not yet taken place worldwide, many of these cards still accommodate the magstripe technology in order to be effective while traveling abroad, and most importantly, to the United States. Because of this delay in technology, hackers have found ways to work around the more secure systems in places like the UK by stealing the information on EMV cards in order to use the data in less secure, magstripe dominated countries. The fact of the matter is, the sooner the antiquated magstripe technology dies out world-wide, the more effective and secure these chip-based card systems will be.

As The US makes the transition from to smart cards, there is still a major security issue in their transition. The issue being the decision to allow chip-and-signature authorization rather than the more secure option of chip-and-pin, which is being used in much of Europe. The chip-and-pin authorization is clearly the more secure option, making fraudulent activity nearly impossible if the card happens to be lost or stolen.

The question then is; who foots the fraudulent bill? In most cases within the US, the consumer is entirely off the hook, leaving it to the bank/credit institution, or, in many cases, the vendor. In October of 2015, blame shifted from the card issuer to the vendors if the technology had not been updated. This implementation however is still incomplete, and vendors are at risk for fraud from both sides now. These vendors are at the mercy of insecure magstripe technology, along with the potential for untrustworthy shoppers, who can deny charges were ever made, when they in fact were.

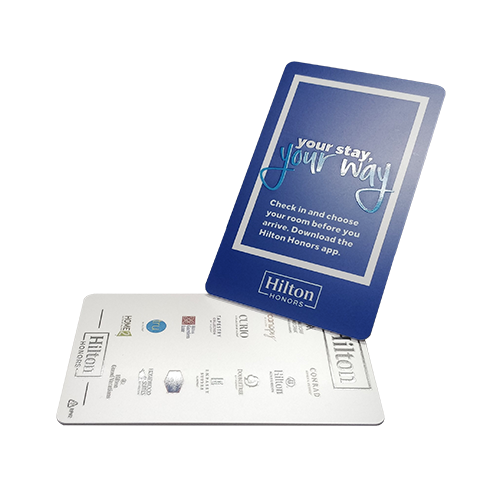

Chip-based card technology offers an increasingly secure environment and is being adopted more commonly now in government, education and health care, retail, hospitality, and access-control markets.

For more information on cost-efficient ways to increase the security of your card technology with chip-based technology, RFID, NFC and EMV technology, please contact Universal Smart Cards at: 1-800-810-4959 or sales@usmartcards.com.

This entry was posted on Usmartcards Blog.

-500x500.jpg)